Bessent Signals Big Beautiful Bailout For Argentina In Vote Of Confidence For Milei

Yesterday, as we detailed here, Argentina assets soared on the heels of US Treasury Secretary Scott Bessent calling the South American country „a systemically important US ally in Latin America,” adding that the US Treasury „stands ready to do what is needed within its mandate to support Argentina. All options for stabilization are on the table.”

This morning, Argentine bonds are extending gains following a follow-up post on X by Bessent that the Trump administration „stands ready to do what is needed to support Argentina and the Argentine people.”

Specifically, Bessent writes that the US is discussing a swap line with Argentina and is ready to buy up the country’s dollar bonds.

“The Treasury is currently in negotiations with Argentine officials for a $20 billion swap line with the Central Bank,” Bessent said on X.

“We are working in close coordination with the Argentine government to prevent excessive volatility.”

Adding:

„In addition, the United States stands ready to purchase secondary or primary government debt.”

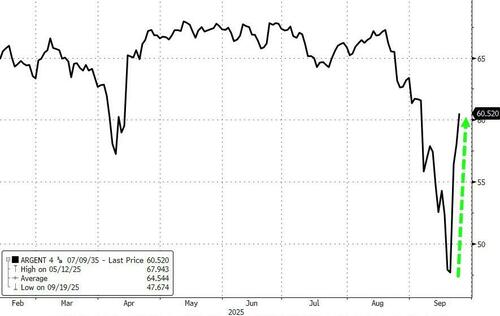

Argentine bonds are ripping higher on the news…

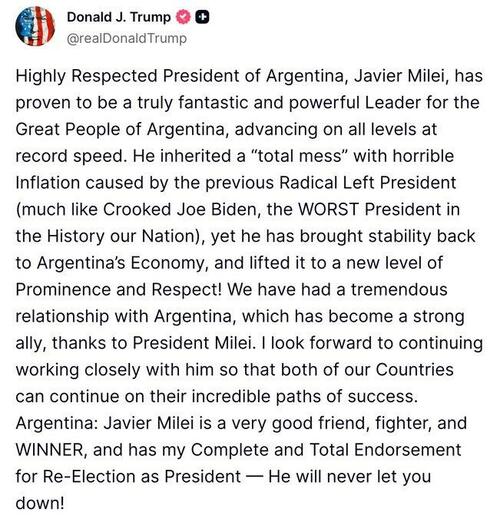

Bessent’s comments come after Trump’s Truth Social post supporting his „very good friend” Javier Milei:

Bessent concluded: „Argentina has the tools to defeat speculators, including those who seek to destabilize Argentina’s markets for political objectives…”

And for now, he is right as the peso is soaring…

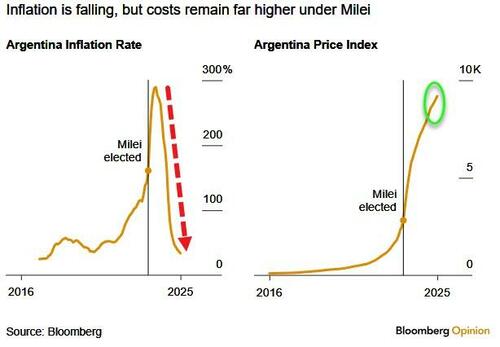

Argentina’s capital markets had been roiled in the past few weeks after a weak showing by President Milei in a local election, but speaking on Fox on Wednesday morning, Bessent called the aid a “bridge to the election,” referencing Argentina’s midterms on Oct. 26.

“I don’t think the market has lost confidence in him, I think the market is looking in the rear view mirror and looking at decades, about a century, of terrible Argentinian mismanagement,” Bessent said.

This marks the second major bailout for Argentina under Trump, as his administration takes on a more prominent role in Latin American politics. In 2018, Trump pushed the International Monetary Fund to approve an initial $50 billion program for the country under then-President Mauricio Macri, a deal that quickly unraveled.

“It clears up uncertainty about the liquidity difficulties generated by the economic program so far,” Federico Filippini, Chief Economist at Adcap Grupo Financiero.

“The announcement that the Treasury would be willing to directly purchase sovereign debt significantly increases the likelihood of a fall in country risk to the point that the government could issue debt in early 2026.”

The Trump administration’s swap line would be bigger than Argentina’s line with China’s central bank, which is about $18 billion.

“For Washington, Milei represents more than an economic partner: He is also a strategic geopolitical ally as the US seeks to build a bloc of like-minded governments in Latin America,” said Claudio Zampa, founder of Switzerland-based Mangart Capital Management.

Finally, as one veteran market-whisperer put it: everyone says they are ready to 'do austerity’ to fix any domestic fiscal shitshow; but, in the end, every voter capitulates and goes with whoever promises free shit. Despite bringing down inflation…

…Milei is facing that free-shit army’s impatience and the hope is that with Bessent’s help, they can survive to fight another election.

As Eugenia Mitchelstein, a social sciences professor at the University of San Andrés in Buenos Aires, points out, the midterm elections allow Argentinians to weigh in on whether Milei has done enough to stabilize the turbulent economy, and could have major ramifications for how he governs going forward. It will be a referendum on the politics of the chainsaw.

We give Bessent the last word on how that works out: „Argentina has the tools to defeat speculators, including those who seek to destabilize Argentina’s markets for political objectives.”

Tyler Durden

Wed, 09/24/2025 – 09:15