CATL Received More Chinese Subsidies In 6 Months Than BYD, Great Wall And SAIC Did All Year

China’s top EV battery maker CATL did not disclose how much it received in state subsidies in its latest full-year report—just before raising $5.3 billion in a secondary share listing in Hong Kong this week.

Previously, CATL had reported this data in line with mainland Chinese disclosure rules. Listed in Shenzhen since 2018, the company became dual-listed in Hong Kong on Tuesday, according to Nikkei Asia.

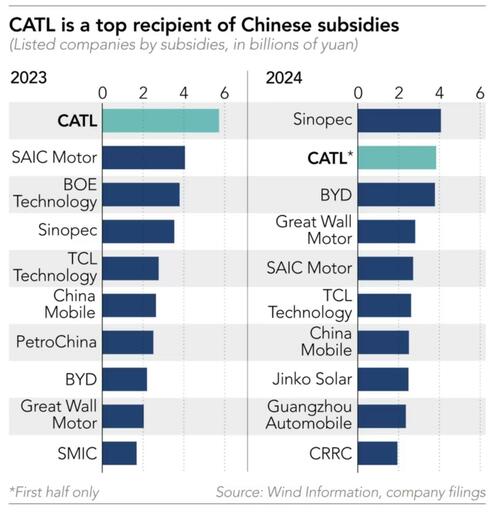

The most recent subsidy figure available is from the first half of 2024: 3.84 billion yuan ($532 million)—the highest among all A-share companies during that period. Despite not reporting second-half subsidies, this was still the second-largest full-year subsidy total, behind only Sinopec (4.06 billion yuan).

Nikkei Asia writes that CATL received more in the first half of 2024 than BYD, Great Wall Motors, and SAIC Motor did for the entire year. It was also the top subsidy recipient in 2023.

These figures come from Wind data and were verified by Nikkei Asia through company filings.

CATL’s reports categorize subsidies under “other income,” specifically “government subsidies.” In interim reports, the amounts match exactly—3.84 billion yuan in 2024 and 2.85 billion in 2023. In its full-year 2023 report, “other income” totaled 6.26 billion yuan, with 5.72 billion attributed to subsidies.

In 2024, “other income” rose 59% to 9.96 billion yuan, but without a breakdown, suggesting additional undisclosed subsidies in the second half of the year.

CATL declined to comment to Nikkei Asia about the missing figures or the change in disclosure. Executives, including Chairman Robin Zeng Yuqun, took no questions at the Hong Kong listing ceremony—a growing trend among mainland firms listing there.

Grant Thornton, CATL’s auditor since 2018, also did not respond to Nikkei Asia. In a press release, it said it helped CATL “navigate complexity” between Shenzhen and Hong Kong regulations, adding: “Grant Thornton China delivered tailored solutions, including financial statement audits.”

Beyond CATL, the list of top subsidy recipients reflects Beijing’s strategic priorities. While state oil giants Sinopec and PetroChina lead for energy security reasons, the inclusion of EV players like BYD, Great Wall, SAIC, and GAC signals strong government support for the electric vehicle industry.

Tyler Durden

Fri, 05/23/2025 – 06:55