ChatGPT, CFA: Robo Stock Picking Market To Grow 600% By 2029

As ChatGPT turns three (has it really only been 3 years?) AI tools are quickly entering investing.

About one in 10 retail investors now use chatbots to pick stocks, according to broker eToro, while half say they would consider it, according to Reuters. The robo-advisory market is projected to soar from $61.75 billion in 2023 to nearly $471 billion by 2029, Research and Markets estimates.

Reuters writes that Jeremy Leung, a former UBS analyst, uses ChatGPT to guide his portfolio since leaving the bank last year. „I no longer have the luxury of a Bloomberg (terminal)… Even the simple ChatGPT tool can do a lot and replicate a lot of the workflows that I used to do,” he said.

But he warns the chatbot can miss crucial analysis since it „can’t access data behind a paywall.”

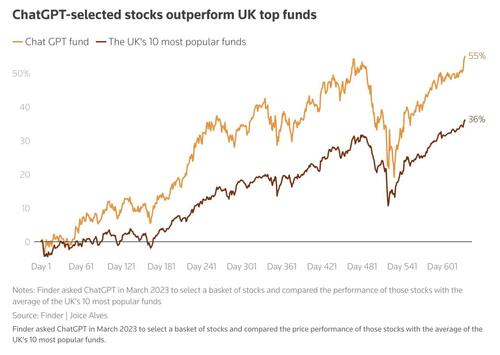

Finder found that 40% of UK respondents had used AI for personal finance. Its own experiment with ChatGPT stock picks in 2023 produced a basket including Nvidia, Amazon, Procter & Gamble and Walmart, which gained 55%—far ahead of leading UK funds.

Still, experts caution against treating generic models like investment platforms.

„AI models can be brilliant,” said eToro’s UK head Dan Moczulski. „The risk comes when people treat generic models like ChatGPT or Gemini as crystal balls.” He stressed that purpose-built AI tools are safer, as general models can „misquote figures and dates, lean too hard on a pre-established narrative, and overly rely on past price action.”

Leung says success depends on detailed prompts, such as „assume you’re a short analyst, what is the short thesis for this stock?” or „use only credible sources, such as SEC filings.”

But he adds that investor enthusiasm may be dangerous: „If people get comfortable investing using AI and they’re making money, they may not be able to manage in a crisis or downturn.”

Tyler Durden

Thu, 09/25/2025 – 18:00