China’s Solar Industry Quietly Fired A Third Of Its Workers

China’s biggest solar firms fired nearly one-third of their workforces last year, a Reuters analysis of company filings shows, as one of the industries hand-picked by Beijing to drive economic growth grapples with falling prices and steep losses. Longi Green Energy, Trina Solar, Jinko Solar, JA Solar, and Tongwei collectively shed some 87,000 staff, or 31% of their workforces on average last year, according to a Reuters review of employment figures in public filings.

The job cuts illustrate the pain from the vicious price wars being fought across Chinese industries, including solar and electric vehicles, as China grapples with massive overcapacity and dismal demand (which has prompted China to dump its exports into any country that will accept them). As a frame of reference, the world produces twice as many solar panels each year as it uses, with most of them manufactured in China.

Analysts say the previously unreported job losses are likely a mix of layoffs and attrition due to cuts to pay and hours as companies sought to stem losses. More importantly, nobody is allowed to mention them: layoffs are politically sensitive in China, where Beijing views employment as key to social stability.

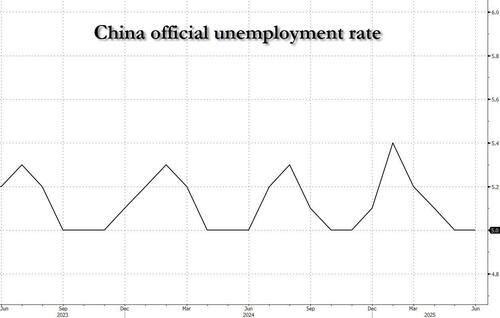

Remarkably, other than a 5% cut acknowledged by Longi last year, none of the firms mentioned above have announced any job cuts or responded to questions from Reuters. Meanwhile, amid tens of millions of wholesale layoffs which are not logged in any official statistics, China continues to pretend that its unemployment rate is 5%, and hasn’t budged in 5 years.

„The industry has been facing a downturn since the end of 2023,” said Cheng Wang, an analyst at Morningstar. „In 2024, it actually got worse. In 2025, it looks like it’s getting even worse.” Just wait until 2026 though…

Since 2024, more than 40 solar firms have delisted, gone bankrupt or been acquired, according to a presentation by the photovoltaic industry association in July.

In a clear example of the catastrophic consequences of central planning, China’s solar manufacturers built new factories at a fever pitch between 2020 and 2023 as the state redirected resources from the sinking property sector to what it used to call the „new three” growth industries: solar panels, electric cars and batteries.

There was just one problem: that building spree led to a collapse in prices, a deflationary tide and a brutal price war made worse by US tariffs thrown up against exports from the many Chinese-owned factories in Southeast Asia. The industry lost $60 billion last year.

While analysts say it is unclear whether job cuts continued this year (narrator: they did), Beijing is increasingly signalling it intends to intervene to cut capacity, sending polysilicon prices soaring nearly 70% in July while solar panel prices have increased more modestly. Still, outside of government stimmies, the domestic demand for all that solar just isn’t there. Come to think of it, the international demand also isn’t there.

Major polysilicon producer GCL told Reuters on Thursday that top producers plan to set up an OPEC-like entity to control prices and supply. The group is also setting up a 50-billion yuan vehicle to buy and shut around a third of the industry’s lower-quality production capacity.

So to summarize: 5 years ago China unleashed a historic stimulus ramp to build up as much solar capacity as it could. Now, drowning in overcapacity, it is unleashing an even more historic ramp to reverse everything it did. Typical communist central planning.

President Xi Jinping in early July called for an end to „disorderly price competition,” the infamous „involution” plan, and three days later the industry ministry pledged to calm price wars and retire outdated production capacity during a meeting with solar industry executives.

While Beijing has not said when or how it will act, a source with direct knowledge of the matter told Reuters it was determined to focus on the issue before the end of the current five-year plan this year. In other words, China will „deal with the problem” exactly the same way every other nation will: by punting and leaving it to the next guy to fix.

Officials in eastern China’s Anhui province, a manufacturing hub, told solar company executives in June to stop adding new manufacturing and shut production lines operating at under 30% capacity, according to two industry sources who declined to be identified due to the sensitivity of the matter.

A board member at a solar firm in the province said new capacity had already required verbal approval from powerful state planner the National Development and Reform Commission (NDRC) this year. They asked for their company’s name to be withheld because the discussions were private. But many provincial governments are likely to be reluctant to crack down hard on overcapacity, analysts say. These officials are scored on jobs and economic growth and are loathe to see local champions sacrificed to meet someone else’s target.

Hilariously, Trina Solar’s chairman told an industry conference in June that new projects had begun this year despite the NDRC calling for a halt in February. The foot-dragging reflects the scale of the cull required. Jefferies analyst Alan Lau estimated at least 20-30% of manufacturing capacity would have to be eliminated for companies to return to profitability.

„There’s a lot of overcapacity in China, like steel, like cement, but you don’t see any industry in the past having industry-wide cash loss for one and a half years already,” Lau said.

Company-level losses are on the same scale as in real estate, another crisis-hit sector, even though solar is only about one-tenth the size, he said. „This is highly unusual and highly abnormal.”

And if you think this is bad, just wait until you learn how absolutely devastating the losses are in China’s auto sector, which we will detail in an article tomorrow…

Tyler Durden

Wed, 08/06/2025 – 05:45