Futures Rise As Alibaba Capex Promise Boosts AI Sentiment Again

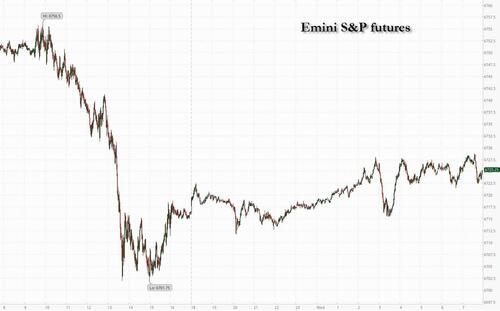

US futures are once again higher after taking a brief pause yesterday, led by Tech, with all of Mag7 higher pointing to a stronger open as Alibaba’s spending promise and Micron’s upbeat outlook lift sentiment on AI. Global stocks resumed their rally after a pledge by China’s Alibaba for more spending (now the mere promise of more capex is sufficient to send your stock ripping) and Micron’s upbeat forecast lifted sentiment on AI (even higher… if that’s possible). As of 8:00am ET, S&P and Nasdaq futures rose 0.2% after big tech’s slide in the prior session broke a streak of records; Mag 7 are all green led by AMZN, +1.6% while TMT is boosted by Micron rising +1.5% after strong earnings underscored the boom’s ongoing momentum. Semis were bid after Alibaba jumped 9% in typhoon-hit Hong Kong on plans to boost AI spending beyond an initial $50 billion target. According to JPM, the AI-theme should perform well today (when does it not), including Critical Metals. Cyclicals are leading Defensives. The curve is steepening as 2Y yields are -2bps and the 10Y rises 3bps to 4.13% as the USD is bid up for first time this week. Trump said that Ukraine, with NATO help, has the tools to win back all of its Russian-occupied territory, included continued US weapons sales to NATO, and should shoot down Russian planes that enter its airspace. Gold held near all-time highs. Today’s macro data focus is on Home Sales, Building Permits and Mortgage Apps.

In premarket trading, Mag 7 stocks are all higher: Amazon (AMZN) gains 1.4% following an upgrade at Wells Fargo on greater conviction in the company’s Amazon Web Services division (Tesla +0.7%, Nvidia +0.6%, Meta +0.2%, Microsoft +0.2%, Alphabet +0.1%, Apple +0.07%).

- Acadia Pharmaceuticals (ACAD) shares are halted after the company said its Phase 3 trial of intranasal carbetocin (ACP-101) in patients with hyperphagia in Prader-Willi syndrome failed to meet its primary endpoint.

- Adobe (ADBE) is down 1.3% as Morgan Stanley downgrades to equal-weight from overweight on decelerating digital media annual recurring revenue.

- Alibaba Group Holding (BABA) shares surged 9% after revealing plans to ramp up AI spending past an original $50 billion-plus target, joining tech leaders pledging ever-greater sums toward a global race for technological breakthroughs.

- Bloom Energy Corp. (BE) falls 6% after Jefferies cut its recommendation on the fuel cell power generator to underperform from hold, saying that valuation reflects high expectations. Analysts see difficulty for the firm to reach 1 GW of power in the near term.

- Lithium Americas (LAC) soars 68% after reports revealed the US is seeking an equity stake in the company as it renegotiates terms of a $2.3 billion government loan.

- PayPal Holdings Inc. (PYPL) climbs 1.3% after Blue Owl Capital Inc. agreed to buy about $7 billion of buy now, pay later loans from the company.

- UniQure (QURE) shares are halted after the company said phase I/II trial of AMT-130 in Huntington’s disease met its prespecified primary endpoint.

In corporate news, OpenAI plans to invest roughly $400 billion it does not have to develop five new US data center sites in partnership with Oracle and SoftBank. Tether is in talks with investors to raise as much as $20 billion, a deal that could propel the crypto firm into the highest ranks of the world’s most valuable private companies. Apollo is rolling out three new private capital funds for wealthy individual investors in Europe.

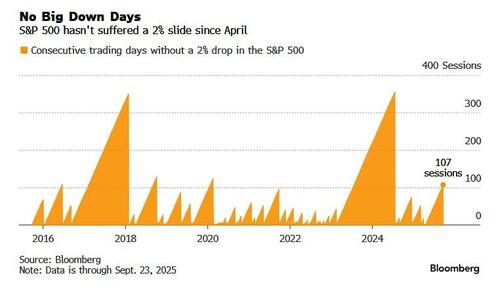

Turning back to the broader market, down days are few and far between at the moment, and the overall sentiment for stocks is becoming euphoric. JPMorgan’s head of market intelligence, Andrew Tyler, sums it up nicely: “several conversations yesterday focused on what could derail this bullish run. My favorite response was an asteroid hitting the earth.” Internal market metrics underscore just how bullish investors have become. Systematic strategies were already almost maxed-out. Now, discretionary investors are stretching to more bullish levels, with room to go further. Options volume is firmly skewed toward chasing the upside. Still, impending portfolio rebalancing may create a technical headwind as the month comes to an end.

In any case, the S&P 500 has gone 107 sessions without a drop of 2% or more, the longest streak in more than a year as hopes for rapid Fed easing have added to the buoyant mood.

Traders are paying little attention to a range of risks, with the threat emphasized Tuesday when Fed Chair Jerome Powell warned that policymakers still face a difficult path ahead. Bullishness over AI’s vast potential has fueled multiple all-time highs in stocks this year, offsetting all worries about rising geopolitical risks and trade tensions.

In the Middle East, Saudi Arabia’s move to ease foreign ownership rules added $123 billion to the country’s stock market. Banking stocks on the Tadawul All Share Index surged a record 9%.

Alibaba shares soared in Asia after CEO Eddie Wu revealed plans to ramp up AI spending above an original target of $50 billion-plus over three years. Micron, which has seen its shares almost double this year, gave an upbeat outlook driven by demand for AI equipment. Also top of mind for tech traders — California’s AG is looking at whether Trump’s $100,000 application fee for H-1B visas can be challenged by law.

„AI is back as the key driver for global markets. Investment continues apace and that’s keeping the AI theme relevant,” said Guy Miller, chief strategist at Zurich Insurance Co. “That leads to the question, is this getting to the last innings with overinvestment and misallocation of capital? From an investor perspective, all that actually tells you there’s a bit further to run.”

According to Bloomberg, the danger now is that officials scale back expectations for further cuts, leaving Wall Street disappointed. San Francisco Fed President Mary Daly speaks later Wednesday, in what is otherwise a light day for the events calendar.

„There’s going to be lots of chatter about the Fed and that’s going to dominate,” said Daniel Murray, deputy chief investment officer at EFG Asset Management. “I expect we’re going to drift for a couple of weeks. The next catalyst is going to be the third-quarter earnings season.”

European stocks slipped 0.3% diverging from gains in Asia and the US, as autos, consumer products and financials underperform. The region’s defense stocks rallied after US President Donald Trump’s latest criticism of Russia. Here are the biggest movers Wednesday:

- European defense stocks rise after President Donald Trump said on Tuesday NATO nations should shoot down Russian aircraft that violated their airspace and struck a more sympathetic tone on Ukraine’s chances of winning the war

- JD Sports shares rise 3.6% after the retailer’s 1H results showed “limited tariff impact,” according to RBC. Analysts said the update also showed market share gains in North America and Europe, and supported an outlook for a better 2H

- Electrolux Professional gains as much as 5.9% after Handelsbanken reiterated its buy rating on the Swedish professional kitchen and laundry equipment maker, saying the upcoming 3Q report and CMD as potential positive triggers

- Bouygues shares rise as much as 2.7% after the construction and telecommunications company was upgraded by Morgan Stanley, which sees limited downside to the current share price

- Metso falls as much as 4.9%, the most since July, after its new financial targets fell short of the most bullish hopes for the Finnish industrial equipment company, which slightly hiked its Ebita margin target

- Lanxess shares fall as much as 5.3% after being downgraded by Deutsche Bank, as analysts say the chemical company is now fairly valued and that the upside from the recent Envalior announcement has been captured

- Asker Healthcare Group falls as much as 6.4% after Swedish pension fund AP6 sold its entire holding in the company at SEK81 per share, representing a 8.9% discount from the previous close

- NCAB falls as much as 7.6%, the most since July, after SEB cut its recommendation on the Swedish printed circuit board maker to hold from buy, saying the company’s valuation has come up and is trading at a 10-21% premium

- Baltic Classifieds falls as much as 15% to the lowest in more than a year, after the firm said in a trading update that full-year revenue and profit is expected to be 3%-4% below its previously communicated guidance

- Pinewood Technologies shares plunge as much as 14% after the software maker’s 2025 Ebitda target disappointed. Berenberg analysts noted a one-off accounting impact and the delay in implementation with a major customer

- On the Beach shares slide as much as 20%, the most since May 2023, after the online package holiday firm’s full-year profit before tax undershot expectations, due to loss-making B2B operations

- Exail Technologies drops as much as 7.7% after completing an offer of its convertible bonds, which led to TP ICAP downgrading the industrial company. That has broken the clean-sweep of buy ratings on the stock

Earlier in the session, Asian stocks advanced, as a boost from Alibaba’s AI spending plans countered a broader regional selloff in tech shares. The MSCI Asia Pacific Index gained 0.2%, with Alibaba the biggest boost while banks including Westpac Banking Corp. and Commonwealth Bank of Australia weighed on the gauge. Equity benchmarks rose in Japan and mainland China, and fell in South Korea, Taiwan and Australia. Meanwhile, the Hang Seng Tech Index surged more than 2% after Alibaba said it would beef up its AI budget and unveiled its new Qwen3-Max large language model. Shares of peers and China’s homegrown tech suppliers climbed, boosting key equity measures on the mainland as well as in Hong Kong. Australia’s main index declined nearly 1% after monthly consumer prices rose more than economists expected, weakening the case for a rate cut next week.

“Asian markets are treading cautiously today, caught between profit-taking and lack of new catalysts,” said Dilin Wu, a research strategist at Pepperstone Group. “After yesterday’s strong US tech rally, much of the initial enthusiasm has faded.”

In FX, the dollar climbs 0.3% after two days of declines. The Australian dollar is the only G-10 currency to outperform the greenback, while the yen is the weakest of the group. The euro slips after an unexpected drop in German business confidence.

In rates, front-end Treasuries outperform while 10Y yields rose 3bps to 4.13% as the curve steepened. Treasury auctions resume at 1pm New York with $70 billion 5-year note sale, follows a solid 2-year note auction Tuesday which stopped 0.1bp through the WI.

In commodities, oil extended its biggest gain in a week, as Trump ramped up his rhetoric against Russia and traders watched for supply disruptions from the OPEC+ member. Brent rose above $68 a barrel and WTI adds 0.4% to $63.64. Sot gold rises about $5 to $3,769 an ounce.

US economic data slate includes August new home sales/building permits (10am). Fed speaker slate includes Daly at 4:10pm, delivering keynote remarks on the outlook for the economy

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.1%

- Stoxx Europe 600 -0.3%

- DAX -0.2%

- CAC 40 -0.3%

- 10-year Treasury yield little changed at 4.11%

- VIX -0.2 points at 16.42

- Bloomberg Dollar Index +0.3% at 1199.14

- euro -0.4% at $1.1768

- WTI crude +0.4% at $63.66/barrel

Top Overnight News

- House Democrats will meet on September 29th in Washington, D.C. to discuss government funding: BBG

- Volodymyr Zelenskiy told Fox News that Donald Trump’s remarks on Ukraine winning back territory from Russia were a big shift and said the leaders have better relations than before. The Ukrainian president speaks today at the UNGA. BBG

- OpenAI, Oracle, and Softbank announced five new US data centres; expects new data centre site to create over 25,000 direct jobs and tens of thousands more across the US. The firm continues assessing further potential locations for expansion.

- China said it would no longer seek new special treatment for developing countries in current and future World Trade Organization negotiations, signaling a possible effort to ease a longstanding friction point with the U.S. ahead of a planned summit. WSJ

- Alibaba shares jumped +9%+ after the company said it would invest more than $53 billion in artificial intelligence—above its original target—and released a new model. WSJ

- Inflation pressures are once again building in Australia, with a monthly reading of price pressures hitting its highest level in just over a year in August. Australia’s Aug CPI overshoots the Street consensus at +3% (vs. the Street +2.9% and up from +2.8% in Jul). WSJ

- Europe’s asset managers are racing to consolidate, with recent high-profile M&As reshaping the industry and creating new trillion-dollar firms. Cash-rich banks are driving deals across France, Switzerland and Italy. BBG

- Bond traders are dialing back Fed rate cut bets for 2025, now pricing in just one more reduction as mixed signals from officials cloud policy expectations. BBG

- A pickup in dealmaking and initial public offerings is helping fuel a hot job market on Wall Street. Big banks had been adding staff over the past year in strategic expansions, but now sudden jumps in activity have them seeking to hire even more and slowing layoffs they might have otherwise executed. WSJ

- Micron shares rose premarket (was up as much as 4% post the print) after giving an upbeat forecast boosted by demand for AI equipment. BBG

- NVIDIA director Mark A. Stevens sold over 350k common shares at an average price of USD 176.3923/shr on 19 September (vs 178.43 closing price on Tuesday)

- US crude inventories fell 3.8 million barrels last week, the API is said to have reported. That would reduce total holdings to the lowest in three and a half years if confirmed by the EIA. BBG

Trade/Tarifffs

- The White House said US President Trump will meet Australian Prime Minister Albanese on 20th October in Washington, according to Reuters.

- Canadian PM Carney said discussions with US President Trump about a Canada-US trade deal will roll into the USMCA review process, noting that talks are ongoing and that Canada will sign when there is the right deal for the country, according to Reuters.

- Canadian PM Carney said he is open to discussions with the Chinese Premier regarding steel tariffs, according to Reuters.

- China’s Commerce Ministry stated it will not seek preferential treatment at the WTO, according to Reuters.

- China’s Premier expressed willingness to enhance cooperation with Canada to improve bilateral relations, according to Reuters.

A more detailed wrap of overnight markets courtesy of Newsquawk

APAC stocks eventually traded mixed following a subdued open as the sentiment from Wall Street initially reverberated, but later improved after Chinese cash trade got underway, whilst Hong Kong remained open despite the Super Typhoon. ASX 200 declined as gold miners weighed following consecutive sessions of outperformance, while Tech mirrored Wall Street sectoral weakness. Nikkei 225 returned from holiday to trade softer in line with the regional tone, though losses were somewhat cushioned by the NVIDIA/OpenAI rally it missed yesterday and a weaker JPY intraday. KOSPI was pressured amid the broader global tech pullback and deteriorating South Korean consumer sentiment. Hang Seng and Shanghai Comp were choppy and eventually traded in the green, with the former also boosted by Alibaba, whose shares surged after releasing its largest LLM whilst announcing plans to ramp up spending on AI infrastructure to better compete with US rivals.

Top Asian News

- New Zealand Finance Minister Willis said Anna Breman will be the new RBNZ Governor, beginning her five-year term on 1st December 2025. Breman will leave her position at the Riksbank on October 10th as she has been appointed the governor of the RBNZ.

- Alibaba (BABA/ 9988 HK) officially released Qwen3-MAX, a 1tln-parameter large language model. CEO announced plans to ramp up spending on AI infrastructure to better compete with US rivals.

- Russian Kremlin states US President Trump is a businessman attempting to pressure global markets into purchasing US oil and gas at elevated prices Praises Trump’s desire to bring an end to the conflict. States that Russian army are advancing in Ukraine and dynamics on the frontline are obvious.

- China announces measures to promote service export, via state media.

European bourses (STOXX 600 -0.3%) began the session around the unchanged mark, but slipped into negative territory, soon after the cash open, but without a clear catalyst – perhaps some focus on the latest hawkish geopolitical rhetoric from Trump. More recently, the complex has picked up from worst levels to currently trade towards the mid-point of the day’s range. European sectors hold a negative bias, and with the breadth of the market fairly narrow today. Utilities is found towards the top of the pile, albeit only marginally so. Iberdrola (+0.8%) announced it will be investing USD 68bln to grow in the UK/US; the Co. also said it sees close to EUR 20bln in dividends between 2025 and 2028. Defence names today have been boosted today after President Trump said Ukraine can win all its land back from Russia.

Top European News

- French PM Lecornu is open to a tax on top earners and firms, via BFM TV.

- German Chancellor Merz says that a true reform is needed to fund the German welfare system. Says Germany will make a concrete proposal on pension system reform this year. Says Germany’s aviation costs need to be lowered. Says Auto, Steel and Chemical sectors are key sectors in Germany and must remain.

- Swiss KOF: cuts 2026 outlook due to the deterioration in competitive conditions caused by US tariffs and ongoing heightened economic uncertainty, adj. GDP forecast at 0.9% in 2026 (prev. 1.5)

FX

- USD is attempting to claw back the losses seen on Monday and Tuesday in a session, which thus far has been void of fresh macro drivers. Docket today fairly thin, focus will be on Fed speak via Daly at 21:10BST, who will be speaking on the economic outlook. DXY has eclipsed Tuesday’s best at 97.45.

- EUR/USD is lower on account of the broadly stronger USD and a disappointing IFO report from Germany. Both the expectations and current conditions prints declined from their priors and printed below the bottom end of analyst estimates, snapping a streak of six consecutive months of increases for the headline business climate metric. Desks remain cognizant of geopolitical tensions after US President Trump’s UN address yesterday, in which he noted that NATO countries should shoot down Russian aircraft if they enter NATO airspace. Finally, in an olive branch to the Left, reports in French press suggest that Lecornu is open to a tax on top earners and firms. EUR/USD has extended its decline on a 1.17 handle.

- USD/JPY has moved back onto a 148 handle, supported by the stronger dollar and incremental JPY weakness after flash PMIs showed a deterioration across all components, commentary highlighted persistent cost pressures and elevated inflation. Elsewhere, focus remains on the outcome of the LDP leadership contest on October 4th with Sanae Takaichi still judged to be the front-runner for the position. As it stands, an October hike is currently seen as a coin-flip by markets. USD/JPY has ventured as high as 148.29.

- GBP is on the backfoot vs. the broadly firmer USD and steady vs. the EUR. Incremental macro drivers from the UK are light in the wake of yesterday’s soft showing for September flash PMI metrics, which were weighed on by angst ahead of the November 26th budget. Ahead of which, the Institute for Government (IfG) is the latest think tank to come out and suggest that Chancellor Reeves needs to consider going back on her “rash” tax commitments and impose serious tax reform. Today’s docket is light in terms of data. However, MPC external member Greene is due to give remarks at 17:30BST on ‘Supply shocks and monetary policy’ (text release is due). Cable has slipped onto a 1.34 handle and below Tuesday’s 1.3488.

- AUD is bucking the trend of the majors and is firmer vs. the USD in the wake of firm Australian CPI metrics, which saw the Y/Y CPI rate climbing from 2.8% to 3.0% – the top end of the RBA’s target range.

- PBoC set USD/CNY mid-point at 7.1077 vs exp. 7.1080 (Prev. 7.1057)

- RBI reportedly likely intervened in NDF markets ahead of local opening to support the INR, according to traders cited by Reuters

Fixed Income

- A slightly firmer start to the day for USTs, though once again ranges are thin and US specific newsflow is light. Currently, USTs hold near the top end of a 112-28 to 113-00 band. Just about eclipsing Tuesday’s 112-30+ peak and last week’s best, which was a tick above that. After the deluge of speakers yesterday, today’s docket is a little quieter but does feature remarks from Fed’s Daly (2027) where we expect text and a Q&A. Before that, the week’s supply continues with 5yr notes due after Tuesday’s 2yr sale, an auction that was ok overall but did show a cooling of demand.

- A contained start for Bunds, firmer by a handful of ticks but also in a thin range with newsflow at the time light and largely digesting leaders remarks on the defense/Ukraine front after Trump’s language yesterday, language that took even Ukraine by surprise. The main update was Ifo, a surprisingly weak release with conditions and expectation printing below the forecast range. Metrics lifted Bunds by around 10 ticks in the minutes after and since have helped lift it to a 128.40 peak and also propped up peers across the board as well.

- Gilts are outperforming vs peers, in a continuation of the strength seen yesterday after poor PMIs and despite soft supply. At a 91.28 peak, but for the most part holding around the midpoint of 91.12-91.28 parameters. UK docket relatively light, supply was unremarkable from the UK, strong enough to keep the benchmark comfortably in the above range. Follows the soft tap on Tuesday, where a chunky price tail sparked notable pressure. Press remains focussed on the budget as more think tanks and other groups offer recommendations as to what Chancellor Reeves should do. Overall, the narrative from such groups is that significant tax cuts are inevitable and as such Reeves may need to break the manifesto pledge around them, in order to raise sufficient funds to cover the gap and avoid having to come back.

- UK sells GBP 4.75bln 4.375% 2030 Gilt: b/c 2.80x (prev. 3.15x), average yield 4.095% (prev. 4.022%), yield tail 0.4bps (prev. 0.1bps), price tail 1.6 ticks.

- Italy sells EUR 2.5bln vs exp. EUR 2-2.5bln 2.10% 2027 BTP Short Term & EUR 3.75bln vs exp. EUR 2-2.5bln 1.10% 2031 and 2.40% 2039 BTPei.

- Germany sells EUR 3.045bln vs exp. EUR 4.0bln 2.50% 2032 Bund: b/c 1.5x (prev. 1.2x), average yield 2.52% (prev. 2.46%), retention 23.88% (prev. 33.13%).

- South Korea will issue JPY 500bln in yen-denominated bonds, according to a Japanese regulatory filing.

Commodities

- Choppy price action across the crude complex thus far. Upticks in oil prices was seen following reports that the Israeli army had taken “another step” in the plan to occupy Gaza city spurred a move higher to peaks of USD 63.86/bbl and USD 68.12/bbl for WTI and Brent respectively. However, the move proved somewhat short-lived. Crude hit by a surprise German Ifo survey, with all metrics falling from the prior and both conditions and expectations printing below the forecast range. Potential demand-side concerns from this weighed and sent benchmarks back to fresh lows for the session of USD 63.25/bbl and USD 67.51/bbl respectively. Further bearish impulse potentially from Russia restarting a second unit at the UST-Luga facility and Russia saying Exxon is not the only firm interested in returning to Russia.

- Spot gold is trading off the new ATH at USD 3791/oz made in yesterday’s session, with the day’s best price USD 12/oz lower at USD 3779/oz. Specifics light thus far, continued focus on the geopolitical drivers outlined above, these factors seemingly helped XAU recoup some of Tuesday’s pressure. However, USD strength is capping a return to mentioned highs.

- 3M LME Copper continues to trade below key USD 10k/ton level and in a tight range amid concerns over Super Typhoon Ragasa. The main move this morning came alongside the German Ifo series, preventing 3M LME Copper from retesting USD 10k/t to the upside and pushing the metal back towards earlier USD 9.96k/T lows. Currently, in the red but just off that trough.

- EU Trade Chief Sefcovic to meet with USTR Greer this week to revive talks on metal tariffs, via Bloomberg.

- US Private Inventories: Crude Stocks -3.82mln (exp. +0.2mln , prev. -3.4mln), Distillate +0.52mln (exp. -0.5mln, prev. +1.9mln), Gasoline Stocks +1.05mln (exp. +0.2mln, prev. -0.7mln), Cushing +0.07mln (prev. -0.38mln)

- Peru’s Antamina mine expects to produce 380k metric tons of copper this year (vs 430k tons in 2024). 2026 copper output forecasts at 450k tons. Zinc production is projected at 450k tons this year (vs 270k tons in 2024).

- Trump officials are seeking an equity stake in Lithium Americas (LAC) as part of the renegotiation of a USD 2.3bln loan for the Thacker Pass lithium project; Lithium Americas has offered the administration no-cost warrants that would equate to 5% to 10% of the company’s common shares, according to Reuters.

- China reported its Crude Steel output fell by 0.7% in August 2025 v August 2024 to 77.4 million tonnes.

- Russia’s Novatek restarts its second processing unit at UST-Luga complex following a fire.

- Iran’s Oil Minister Paknejad says UN sanctions won’t create a burden on restrictions of oil sales.

Geopolitics: NATO

- US Defense Secretary Hegseth spoke with his Estonian counterpart and affirmed that the US stands with NATO allies, stressing that any incursion into NATO airspace is unacceptable, according to the Pentagon.

- G7 Foreign Ministers’ Joint Statement: G7 expresses concern over Russia’s latest airspace violations in Estonia, Poland, and Romania; G7 discussed imposing additional economic costs on Russia

Geopolitics: Ukraine

- Ukrainian President Zelensky said he was surprised at US President Trump’s recent comments on Ukraine but welcomed them as “a very positive signal” that the US and Trump would support Kyiv until the end of the war, according to Reuters.

- Ukraine hits Russia’s Neftekhim Salavat plant with drones overnight, says Reuters citing sources.

- Russian Kremlin says the Ukraine war is not an „aimless war” and the idea that Ukraine can win something back is „deeply mistaken”.

- Russian Kremlin states that improved relations with US is moving slow than would like; wants to remove 'irritants’ in US ties; remains open to areas for profitable cooperation with US

Geopolitics: Middle East

- French President Macron said he will meet with the Iranian President on Wednesday to discuss the return of UN sanctions, according to Reuters.

- US envoy Barrack said Israel and Syria are close to reaching a “de-escalation” arrangement under which Israel would halt its bombings and Syria would not move military equipment toward the border, with a security agreement to follow, according to Al-Monitor.

- Israel’s army has taken „another step” in the plan to occupy Gaza city, via Alhadath citing Walla

US Event Calendar

- 5:00 am: Aug F Building Permits, est. 1312k, prior 1312k

- 7:00 am: Sep 19 MBA Mortgage Applications, prior 29.7%

- 10:00 am: Aug New Home Sales, est. 650k, prior 652k

- 10:00 am: Aug New Home Sales MoM, est. -0.31%, prior -0.6%

Central Bank Speakers

- 4:10 pm: Fed’s Daly Gives Keynote Remarks on Monetary Policy

DB’s Jim Reid concludes the overnight wrap

Markets struggled to keep up with the recent momentum yesterday, with the S&P 500 (-0.55%) finally slipping back after a succession of record highs, with a couple of main drivers for this retreat. One was a reversal in tech as there were as many questions as answers over Nvidia’s high profile $100bn tie-up with OpenAI from Monday. The other was a slightly more cautious tone on the labour market by Fed Chair Powell. Meanwhile, concerns also grew about a potential government shutdown next week. To be fair though, it wasn’t all bad news, as US Treasuries finally rallied after a run of 4 consecutive declines since the Fed meeting, and gold prices (+0.46%) hit a fresh record of $3,764/oz.

Powell’s prepared remarks on the economic outlook largely echoed his post-FOMC comments last week. The Chair said that “Two-sided risks” on inflation and the labour market “mean that there is no risk-free path” and avoided giving a firm rate cut signal for the upcoming meetings. However, in the Q&A he appeared to lean a little more into the dovish arguments, noting that “we do see meaningful weakness in the labor market“. While the comments had little impact on near-term Fed pricing, with 44bps of cuts being priced in by year-end (+0.6bps on the day), they reinforced a moderate rally in Treasuries. By the close, 2yr yields were -1.7bps lower at 3.59%, whilst the 10yr yield was down -4.1bps to 4.11%.

Earlier in the day, we’d already heard from several other Fed speakers, although the message was pretty divergent. For instance, Vice Chair for Supervision Bowman (voter) struck a dovish note, saying “it is time for the committee to act decisively and proactively to address decreasing labor market dynamism and emerging signs of fragility”. For context, Bowman has been widely reported as one of the candidates to become Fed Chair, and voted for a 25bp cut at the July meeting where they held rates steady, so has been one of the more dovish members recently. Otherwise, Chicago Fed President Goolsbee (voter) was more cautious, saying that “with inflation having been over the target for four-and-a-half years in a row, and rising, I think we need to be a little careful with getting overly, up-front aggressive.” And it was a similar message from Atlanta Fed President Bostic (non-voter), who said that “it’s incumbent upon us to continue to stay vigilant in the fight against inflation.”

Whilst Fed speakers provided the main headlines, an important developing story has been on the potential for a US government shutdown next week. For those who haven’t been following, government funding currently runs out on September 30, unless Congress vote to authorise more spending. And even though the Republicans have a majority in both chambers of Congress, they need 60 votes in the Senate to avoid a filibuster, when they only have 53 among themselves. Meanwhile, the Democrats are calling for an extension of healthcare subsidies, so there’s an impasse as it stands. There had been a meeting planned between President Trump and the House and Senate Democratic leaders, but Trump cancelled the meeting yesterday, posting that “I have decided that no meeting with their Congressional Leaders could possibly be productive.” So that cancellation has led to a fresh bout of concern that funding will run out at next week’s deadline, and we could see the first shutdown since the winter of 2018-19. Meanwhile, Trump’s main appearance yesterday was a combative speech at the UN, as he accused the organisation of offering only “empty words” and criticised other countries’ climate and immigration policies. Trump later seemed to give his clearest support to Ukraine yet suggesting that the country is in a position to win all its territory back. So that was a change in emphasis.

US equities fell back, with the S&P 500 (-0.55%) posting its worst day in three weeks, while the NASDAQ (-0.95%) and the Mag-7 (-1.55%) saw even larger declines. All of the Mag-7 moved lower, including a -3.04% slide for Amazon, but it was Nvidia’s -2.82% decline that was the main story. This reversed much of Monday’s +3.93% gain after it announced it would invest as much as $100bn into OpenAI. Investors have been left grappling with many questions around the deal. A more practical one is on the timing of the planned data center roll out and whether this can access sufficient power grid capacity. But the bigger concern from an AI bubble risk perspective was whether Nvidia was now relying on investments into customers to feed its revenue growth and whether we’re beginning to see some creative accounting reminiscent of 1990s telco deals.

Over in Europe, there was much more of a risk-on tone yesterday after the September flash PMIs painted a picture of ongoing resilience. Most notably, the Euro Area composite PMI moved up to a 16-month high of 51.2 (vs. 51.1 expected), which added to the optimism around European growth, particularly with the fiscal stimulus ahead. Nevertheless, there was a pretty divergent picture across different countries. Germany led the advance, with its composite PMI rising to 52.4 (vs. 50.7 expected), which was also a 16-month high. But France’s composite PMI fell back to a 5-month low of 48.4 (vs. 49.7 expected). By comparison, the US composite PMI saw a -1.0pt decline albeit to a still solid level of 53.6 (vs. 54.0 expected).

That positive backdrop helped to lift European equities, with the STOXX 600 (+0.28%) moving higher, alongside the DAX (+0.36%) and the CAC 40 (+0.54%). European bond yields also ended the session a bit higher, with yields on 10yr bunds (+0.1bps) and OATs (+0.4bps) inching up. Over in the UK however, there was a bit more weakness, with the FTSE 100 (-0.04%) losing ground after the country’s flash PMIs surprised on the downside. Indeed, the composite PMI fell to a 4-month low of 51.0 (vs. 53.0 expected), which also put downward pressure on gilt yields, with the 10yr yield down -3.3bps on the day.

Asian equity markets are mostly lower this morning outside of a bounce back for China risk. The KOSPI (-0.80%) is an underperformer, impacted by declines in regional technology stocks, while the S&P/ASX 200 (-1.07%) is seeing larger losses also after higher-than-anticipated CPI has dampened expectations for additional interest rate reductions from the RBA (details below).

The Nikkei is rallying back to flat as I type after a holiday yesterday. Conversely, Chinese stocks are defying the regional negative trend, with the Hang Seng (+0.91%), and the Shanghai Composite (+0.63%) seeing gains due to optimism surrounding potential stimulus measures from Beijing. Outside of Asia, US equity futures are fairly flat along with US Treasuries after their rally yesterday.

Returning to Australia, CPI increased by +3.0% year-on-year in August (compared to +2.9% expected; +2.8% in July), marking the highest reading in a year, primarily driven by housing costs. Although the RBA’s preferred trimmed mean measure, which excludes volatile items such as food and energy, decreased to +2.6% in August from 2.7% in the previous month, based on some of the components in the release our Q3 trimmed mean CPI forecast for Q3 is now at 0.8%qoq/2.7%yoy. The RBA’s forecast as outlined in the August SMP was for a 0.6%qoq/2.5%yoy print. As such DB has changed its call for November from a cut to a hold. We still expect cuts in February and May next year but a terminal rate that is now 25bps higher at 3.1%. See our report here.

Following the release of this data, the Australian dollar recovered from losses to trade +0.26% higher, settling at 0.6616 against the dollar, while yields on the policy-sensitive 3yr government bonds rose by +7.5bps to trade at 3.52%, as markets adjusted their expectations for the next rate cut.

In a separate report, Japan’s manufacturing activity contracted more than anticipated in September, with the S&P’s preliminary manufacturing PMI dropping to 48.4, down from 49.7 in the previous month, as overseas demand faced pressure from high US trade tariffs. Simultaneously, the S&P Global Flash Japan Services PMI increased to 53.0 in September, slightly slower than the 53.1 recorded in August, but still comfortably within growth territory. Staying with Japan, our economist has published a „what we need to know” about the LDP leadership battle.

To the day ahead now, and data releases include the Ifo’s business climate indicator from Germany for September, and US new home sales for August. Central bank speakers include San Francisco Fed President Daly, and the BoE’s Greene.

Tyler Durden

Wed, 09/24/2025 – 08:33