Goldman Raises Tesla Delivery Estimates, Notes Improving Brand Sentiment

Wall Street analysts are chasing Tesla stock as it trades above $400 a share, following news that Elon Musk purchased $1 billion worth of shares to start the week.

Looking ahead, Tesla’s third-quarter delivery report is expected in less than two weeks, and Goldman analysts have raised both their delivery estimates and price targets. Goldman’s data also shows sentiment around Tesla has improved after plunging earlier this year, when the Democratic Party’s dark-money-funded NGO machine waged war on Musk over his DOGE efforts.

Members of the Socialist Rifle Association have been charged in the attack on the ICE facility in Alvaredo, TX in which a police officer was shot in the neck, and in two firebombings of Tesla dealerships (political attacks against @elonmusk). Another joined a foreign terror org. pic.twitter.com/StMPgjQtRS

— Luke Rosiak (@lukerosiak) September 18, 2025

A team of analysts led by Mark Delaney upgraded their third- and fourth-quarter delivery estimates for Tesla vehicles:

-

3Q25: 455K (prev. 430K; consensus 439K)

-

4Q25: 450K (prev. 443K; consensus 441K)

-

2026: Unchanged at 1.865M, in line with consensus

„We attribute the better 2H volumes in part to the recent Model Y L launch, in part based on somewhat better consumer survey data, and in part with IRA EV purchase credits set to expire on 9/30/25,” Delaney wrote in a note to clients.

Even with the upgraded quarterly delivery estimates, Delaney’s team maintains a „Neutral” rating on the stock. However, they raised their 12-month price target to $395 from $300. Here’s the explanation:

We remain Neutral rated on the stock. Longer term, we expect Tesla to grow its EPS driven in part by larger contributions from autonomy and robotics, although our base case expectation for profits in these areas is more measured than the company is targeting. As we detail in this note, we estimate that its 2030 EPS could be ~$2-3 to ~$20 (although we acknowledge there are outcomes beyond these ranges), and what we consider to be a middle of the road type scenario implies ~$7-$9 of EPS in 2030 and an EPS CAGR of ~40-50%. Given the move higher in market multiples more generally, as well as the growth rate we believe the business can support over the longer term, plus the increases we make to our forward EPS estimates, we raise our 12-month price target to $395 from $300. If Tesla can have outsized share in areas such as humanoid robotics and autonomy, then there could be upside to our price target, although if competition limits profits (as is happening with the ADAS market in China) or Tesla does not execute well, then there could be downside.

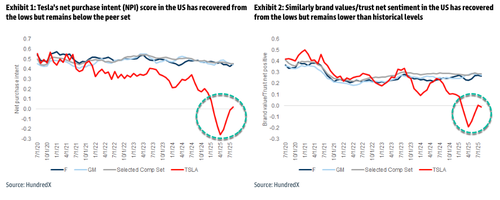

New consumer survey data from HundredX and Morning Consult, which tracks net purchase intent and net buzz around the vehicle brand, shows sentiment improving. Earlier this year, Democratic Party–aligned dark-money-funded NGOs waged an informational war against Tesla over Musk’s involvement with DOGE, but with that propaganda campaign subsiding many months ago, consumers appear to be returning to the brand.

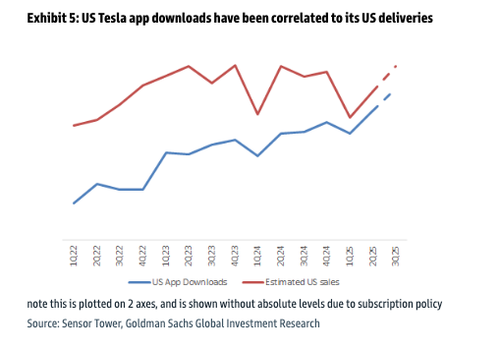

App downloads are also showing a promising inflection point for the brand.

For the full report and chart pack, ZeroHedge Pro Subs can find the note in the usual place.

Tyler Durden

Fri, 09/19/2025 – 13:25