Japan PM Ishiba Vows To 'Stay On’ Despite Ruling Coalition Facing Major Loss; Exit Polls Show

Update (1015ET): The governing coalition of Prime Minister Shigeru Ishiba is likely to lose a majority in the smaller of Japan’s two parliamentary houses in a key election Sunday, according to exit polls, worsening the country’s political instability.

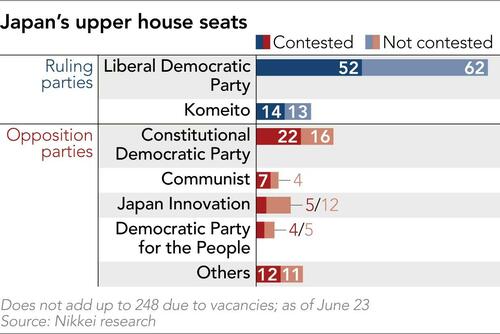

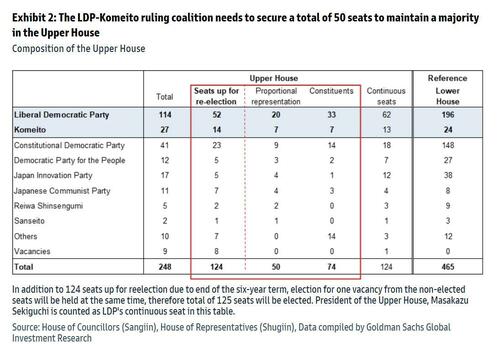

Voters were deciding half of the 248 seats in the upper house, the less powerful of the two chambers in Japan’s Diet.

Ishiba has set the bar low, wanting a simple majority of 125 seats, which means his Liberal Democratic Party, or LDP, and its Buddhist-backed junior coalition partner Komeito need to win 50 to add to the 75 seats they already have.

That would mean a big retreat from the 141 seats they had before the election.

The LDP alone is projected to win from 32 to 35 seats, the fewest won by the party, which still is the No. 1 party in the parliament.

“It’s a tough situation. I take it humbly and sincerely,” Ishiba told a live interview with NHK.

He said that the poor showing was because his government’s measures to combat price increase have yet to reach many people.

“I will fulfill my responsibility as head of the No. 1 party and work for the country.”

Today’s vote comes after Ishiba’s coalition lost a majority in the October lower house election, stung by past corruption scandals, and his unpopular government has since been forced into making concessions to the opposition to get legislation through parliament.

It has been unable to quickly deliver effective measures to mitigate rising prices, including Japan’s traditional staple of rice, and dwindling wages.

A loss of control of the upper house would make Ishiba’s administration the first LDP-led government to rule with a minority in both houses of parliament for the first time since the party’s formation in the 1950s.

Finally, as AP reports, just as we have seen in other regions around the world, frustrated voters are rapidly turning to emerging populist parties.

The eight main opposition groups, however, are too fractured to forge a common platform as a united front and gain voter support as a viable alternative.

If the exit polls hold true (and it appears they are) then Scenario B (below) is in play.

* * *

Voting in Japan’s upper house election began Sunday at 7 am local time across more than 44,000 polling stations, in a ballot where tackling inflation and immigration policy have become key political issues and where simmering discontent over inflation and unresolved negotiations with the US on tariffs will could end the career of prime minister Shigeru Ishiba.

A total of 125 of the chamber’s 248 seats are up for election, including 50 seats allocated by proportional representation and one by-election for a vacant Tokyo seat.

Voting finishes at 8 pm, and results will start coming in late Sunday night and continue into early Monday morning. Japanese citizens aged 18 or older have the right to vote.

The Liberal Democratic Party, which has been the ruling party for most of Japan’s postwar history and coalition partner Komeito need 50 seats to maintain a majority in the upper house. But according to Nikkei and various local media outlets, that looks increasingly challenging, based on recent polls.

„I do not necessarily look for an immediate change of government, but I believe we need more ideas for the economy than just from the LDP,” Hiroyasu Kan, a 28-year-old male in Tokyo, told Nikkei Asia on Sunday. He cast his vote for a party that he believes offers „concrete policy proposals and has actually delivered on them.”

Having already lost its majority in the lower house election last October, another defeat would mean the ruling coalition losing control over the Diet and the legislative process. That raises myriad possible outcomes, including the resignation of Prime Minister Shigeru Ishiba and a snap general election, which could lead to a change in government. This in turn would lead to a plunge in the yen, and could have profound consequences for both the Japanese and global bond markets (see „Will Japan’s Rice Price Shock Lead To Government Collapse And Spark A Global Bond Crisis”).

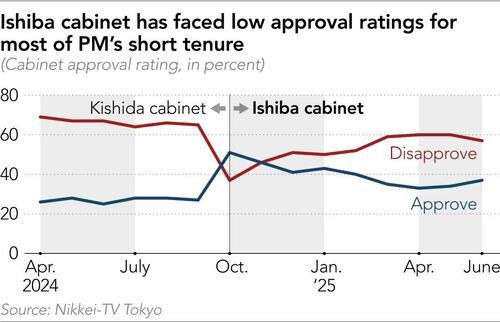

A loss for Ishiba, who has struggled with low approval ratings throughout his short tenure, will also complicate Japan’s trade negotiations with the U.S., with the Aug. 1 deadline to avoid a threatened 25% „reciprocal” tariff fast approaching. „A defeat of the LDP-Komeito coalition may raise concerns about no deal,” said economists at UBS.

In the run-up to the vote, the electorate has increasingly become disgruntled over soaring inflation – especially for rice – and stagnant wage growth. Core consumer prices, which do not include volatile fresh food prices but do include rice which has exploded higher due to poor planning and supplies, rose 3.3% in June from a year earlier, above the Bank of Japan’s 2% target.

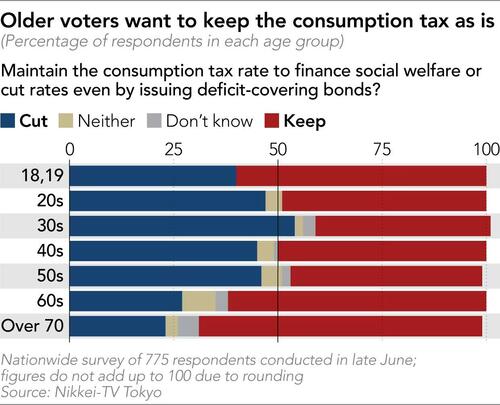

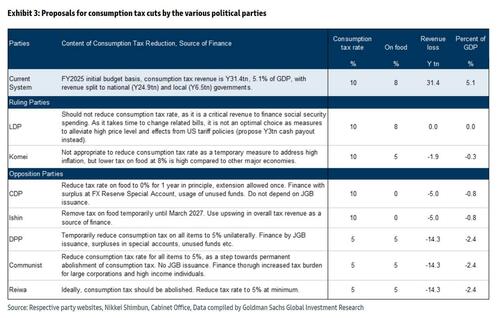

The election is in some ways a competition of who can offer more „free shit”: the opposition parties have gained wide support for advocating a cut to the consumption tax, which is a form of value-added tax (VAT), to alleviate the cost-of-living crisis. The ruling coalition, by contrast, has offered a one-time cash handout, arguing that a one-off payment would be quicker to implement, and that revenue from the tax is needed to maintain the country’s social welfare system.

A man in his 20s on Sunday voted in Tokyo for one of the rising new political parties that advocates tax cuts. „Through social security reform, I expect to see an increase in take-home pay in our working generation.”

With the aging of the population in Japan, the burden of social security costs on workers has become heavier. If they have more spendable income, he said, the younger generation can spend more, and the economy would become more active. Alas, it would mean that Japan – which is already the world’s most indebted nation – would need to issue even more debt which would make another round of debt monetizing QE by the BOJ more likely.

Voters cast their ballots in Japan’s upper house election at a polling station in Tokyo on July 20.

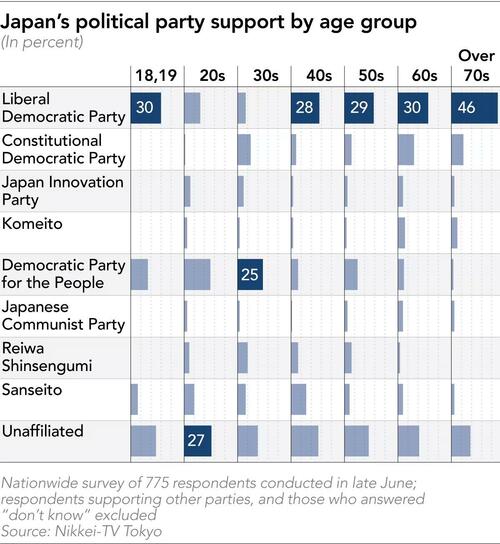

Voters cast their ballots in Japan’s upper house election at a polling station in Tokyo on July 20. The issue of taxation has reverberated beyond the traditional left-right political axis, with supporters of fringe parties like the left-wing Reiwa Shinsengumi and the right-wing Sanseito overwhelmingly favoring a cut, according to a Nikkei-TV Tokyo poll in June.

Kazuki Oikawa, a male voter in his 20s, told the Nikkei that he voted for an opposition party, supporting its economic policies. „I hope a change in government will bring a breath of fresh air to Japanese politics. I did not really like the way the LDP just went with handing out cash.”

On the other hand, Teruko Aoki, a 94-year-old female, said, „Opposition parties only talk about tax cuts and spending increases these days, such as more child care benefits. But where will the money come from for all those tax cuts and spending increases?”

Answer: The same place it will come to fund the cash handouts: more debt.

Among various age groups, those in their 60s and the over-70s strongly support holding the consumption tax rate – 10% for general goods and 8% on food items – steady. The LDP enjoys its strongest support among older voters, the poll showed.

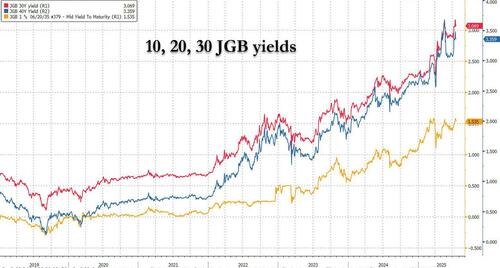

Concerns that Sunday’s vote will force the LDP to make concessions to smaller parties touting policies that will strain public finances have led to a sell-off of Japanese government bonds and the yen. Yields on 10-year Japanese government bonds hit their highest level since the 2008 financial crisis last week. Yields on 20, 30 and 40 year JGBs are at or near all time highs.

Immigration policy also become a key topic of the campaign, especially since Sanseito, which advocates a „Japanese first” stance, won its first seats in the Tokyo Metropolitan Assembly elections last month, in what could be a bellwether for the upper house. The party won its first national seat in the 2022 upper house elections and has three seats in the lower chamber.

While Japan has simultaneously promoted policies to accept more foreign workers and attract more overseas tourists, the resulting cultural friction has led to growing concerns over how the country can continue to absorb the influx in the future (a question politicians in Europe should certainly be asking too).

Many voters feel that they are being pushed aside as a result of the yen’s depreciation and rise in living costs over the past few years.

„This time, I wanted to vote for a party focused on policies more for the middle-class Japanese people,” said Yuki, a female voter in her 30s who did not mention her family name. „It is really hard for Japanese people to buy houses now, and our wages aren’t increasing.” Many in the US could sympathize.

Support for Sanseito, according to the Nikkei-TV Tokyo poll, is highest amongst those in their 40s, a group that makes up the bulk of the so-called lost generation. This cohort began job hunting between 1993 to 2004, during a time of economic stagnation and a glut in the labor market. Unable to find stable jobs, many ended up as part-time employees or freelancers.

„In Europe and in the U.S., widening inequality, immigration and the refugee issue, and high inflation, have led to declining government approval ratings and ruling parties losing elections,” said Goken Suezawa of Nikko Securities in a note. He said national elections in the U.K., France, Japan, the U.S. and Germany resulted in the defeat of ruling parties. „The situation in our country has begun to resemble that of Europe and the U.S.”

Election Scenarios

In today’s Upper House election, 125 of the 248 seats are up for reelection (half seats of 124, plus one vacancy). Looking at the number of Upper House seats and reelection/non-reelection seats, the ruling coalition has 75 non-reelection seats. Therefore, if the coalition were to secure 50 of the 66 seats running for reelection in this time, it would maintain a majority in the Upper House. If the ruling coalition were to win 49 or fewer reelection seats, it would lose its majority in the Upper House, as in the Lower House.

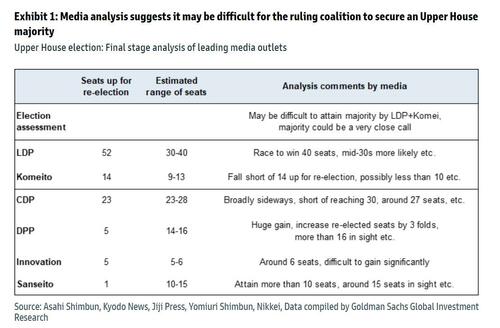

Initial assessments by media outlets, immediately following the election announcement on July 3, largely suggested that the ruling coalition of the LDP and Komeito would secure a majority, including non-reelection seats. However, in their recent analysis of the final stages of the election campaign, media outlets have taken a step back, with most now describing the LDP-Komeito coalition’s prospects for maintaining a majority as difficult or uncertain. Many outlets predict that the LDP will secure around 30-40 of the 52 seats up for reelection, and that Komeito will win fewer than its 14 contested seats.

Scenarios for government based on election outcome.

Below we present Goldman’s various scenarios for the Japanese government depending on the Upper House election outcome.

A. The ruling coalition maintains a majority in the election (wins 50 or more reelection seats)

Ishiba continues as LDP president, and the Ishiba administration continues.

B. The ruling coalition loses its majority (wins 49 or fewer reelection seats)

-

If the ruling coalition loses its majority by a small margin, the Ishiba administration may continue, but Diet management could require more revisions to bills incorporating opposition proposals than before (need to cooperate with opposition parties bill by bill).

-

Ishiba resigns as LDP president. A new LDP president is elected and becomes prime minister (as with 1 above, need to cooperate with opposition parties).

-

If the ruling coalition loses its majority by a large margin, a third party may join the LDP and Komeito to form a new administration, given the difficulty of controlling the Diet. In this case, the leader of the third party could become prime minister.

-

The Ishiba Cabinet resigns en masse, and a coalition government is formed by the current opposition parties.

-

Either the prime minister dissolves the parliament, or a no-confidence motion against the LDP/Komei Cabinet is passed by the opposition parties, and a Lower House general election is held. Depending on the result of the Lower House election, either the LDP/Komei ruling coalition could maintain power or the opposition parties could take power.

Post-election policies may have an expansionary fiscal bias

The Diet is already operating with a minority government, as the ruling coalition is short of a majority in the Lower House. Many bills, including the FY25 budget, have been passed after incorporating the opinions of opposition parties. If the LDP-Komeito coalition were to also lose its majority in the Upper House, cooperation with the opposition would become even more crucial for passing legislation, even if the LDP-Komeito administration were to continue.

One of the most pressing issues is inflation, which has been at the heart of debate during the Upper House election campaign. The LDP has stated that it will not cut the consumption tax, proposing instead cash handouts exceeding a total of ¥3 tn (c.0.5% of GDP) as its core inflation policy. These handouts would be funded by the increased portion of tax revenue in the FY24 budget.

On the other hand, almost all opposition parties call for a cut in consumption tax. However, the scale of the proposed cuts, their duration, and funding sources vary widely (Exhibit 3). Whereas the CDP and Japan Innovation Party suggest a temporary 1-2 year reduction limited to food and funded without relying on additional JGB issuance, the DPP proposes a uniform reduction in consumption tax to 5%, funded by JGB issuance.

A reduction in consumption tax is a tall order under an ongoing LDP-centered administration, according to Goldman. This is because consumption tax cuts require legislative amendments and other time-consuming procedures, making them unsuitable as an immediate action to address inflation, with implementation only possible from April of next year at the earliest. In our view, it would also be politically difficult to revert to the original higher tax rate after only a short period, while securing permanent alternative funding sources would likely prove challenging if the timeframe for a reduced consumption tax were extended.

That said, the economic package the LDP plans to formulate in the fall would likely incorporate some of the demands from opposition parties, such as the abolition of the provisional gasoline tax (¥1.5 tn), which many opposition parties are calling for, and increased spending on childcare and other areas, in addition to the ¥3 tn in cash handouts. Moreover, as seen with the FY25 budget, the LDP-Komeito coalition, as a minority government, would unlikely be able to pass the FY26 initial budget (to be formulated towards the end of 2025) without incorporating some of the opposition’s proposals related to social security (childcare, medical expenses, etc.). Thus, even under an LDP-centered administration, we believe future policy management will inevitably have an expansionary fiscal bias, while still taking heed to some extent of fiscal discipline.

In Japan, where the primary balance deficit has been shrinking on the back of rising tax revenues, and the burden of interest payments is small for the time being, a short-term tax cut or spending increase that leads to a larger primary balance deficit would be unlikely to cause a rise in the debt/GDP ratio in the near term. However, according to our model assuming various scenarios, permanent tax cuts exceeding 1% of GDP would lead to a continuous rise in the debt/GDP ratio, undermining the sustainability of government debt. If defense spending were to increase to 3% of GDP, there would be virtually no room for permanent tax cuts.

It is unlikely that the election results will significantly impact BOJ monetary policy. According to Goldman economists, it is unlikely that the outcome of the Upper House election will have a significant impact on the Bank of Japan’s (BOJ) monetary policy. The BOJ is concerned about the risk that higher tariffs, especially on automobiles, could put downward pressure on growth and inflation amid high uncertainty. Therefore, regardless of the election outcome, the BOJ should maintain a dovish stance from a risk management perspective and choose to keep interest rates on hold for a considerable period. Should higher tariffs come to pass, it is unclear if and when the BOJ would proeed with its next rate hike.

* * *

Suggested Trades, from Goldman’s trading desk:

- SCENARIO 1: LDP/Komeito lose majority but hold PM seat (65% Probability)

In this most likely outcome, Goldman considers the scenario in which the LDP/Komeito lose majority but keeps the premiership 1) no opposition form a majority coalition or 2) a third opposition party joins the LDP/Komeito to form a new government. Although increased opposition influence suggests an expansionary fiscal bias, any changes to the administration could impair Japan’s ability to negotiate a trade deal ahead of the August 1st deadline. While our macro desk expects USDJPY to trade higher if LDP/Komeito lose its majority (which should in theory be equity market supportive), political uncertainty will likely weigh on markets near-term. In this scenario, we like putting on a broad index hedge in dual binary format (market lower and UDSJPY higher) with 13x max payoff:

TRADE IDEAS:

- 1/ BUY NKY LOWER/USDJPY HIGHER DUAL BINARY: 12Sep25 NKY100% @ 7.50% Offer, Max PO 13.3x. Max loss is premium spent.

* * *

- SCENARIO 2: LDP/Komeito maintain majority (25% Probability)

If LDP/Komeito maintain a majority (“status quo”), we likely will see a reversal of MTD price action (chart below). We would expect a relief rally in equities on reduced political uncertainty. At a sector level, defense would likely be a key beneficiary (PM Ishiba supports increased defense spending). As for trade talks, this outcome should have relatively more positive/neutral impact as any change in leadership would be likely to cause further delays. Banks have outperformed in recent weeks and could correct.

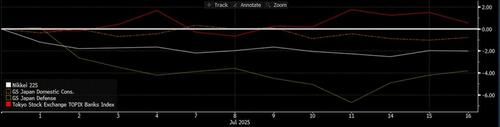

MTD we have seen NKY, Defense, and Domestic Consumption lower vs Japan Banks higher

Source: Bloomberg data as of 16Jul25. Past performance is not indicative of future results.

TRADE IDEAS:

- BUY NKY CALLS: NKY 45Sep25 105% Call: 1.25% offer, 19.43v, 22.5d; Max loss is premium spent.

- BUY TPNBNK PUTS: TPNBNK 10Oct25 95% put 3.72% offer, 28.3v, 36d; Max loss is premium spent.

- BUY GS JAPAN DEFENSE: GSXAJPDF; Max loss on Long TRS is notional + financing spent. Max loss on Short TRS is unlimited.

MTD we have seen NKY, Defense, and Domestic Consumption lower vs Japan Banks higher

- SCENARIO 3: Complete change in administration (10% Probability)

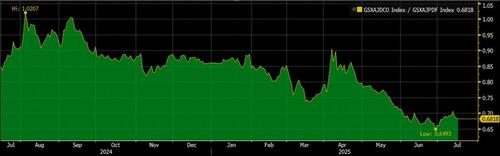

Tail scenario where the LDP/Komeito lose its majority by a wide margin and the Ishiba cabinet is replaced. This scenario would likely have negative implications for tariff talks in near term, but would imply more expansionary fiscal policy in the future. In addition, Ishiba’s removal will have significant negative implications for Defense spending. In this case, the desk likes buying Domestic Consumption names that would benefit from fiscal expansion, paired with a short in Defense for a net market neutral implementation.

TRADE IDEAS:

- BUY JAPAN DOMESTIC CONSUMPTION: GSXAJDCO (Max loss on Long TRS is notional + financing spent. Max loss on Short TRS is unlimited.

- SHORT JAPAN DEFENSE: GSXAJPDF (Max loss on Long TRS is notional + financing spent. Max loss on Short TRS is unlimited.

Long Domestic Consumption vs Short Defense trade should see a reversal if we see a complete change in administration

Tyler Durden

Sun, 07/20/2025 – 10:15