Tailing 5Y Auction Sees Record High Directs, Record Low Dealers

After yesterday’s stellar, blowout 2Y auction, moments ago the US sold $70 billion in 5Y paper in what was a far weaker auction.

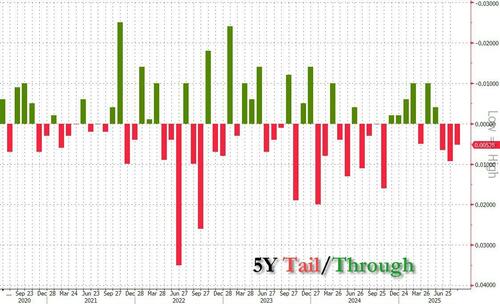

The high yield was 3.724%, down from 3.983% in July and the lowest since last September’s 3.519%; it also tailed the When Issued 3.717% by 0.7bps, the 3rd tail in a row.

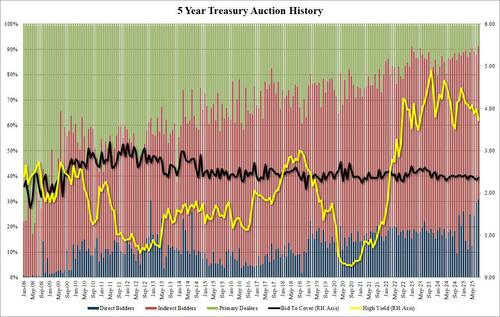

The Bid to Cover was 2.36, up from last month’s ugly 2.31, but below the six auction average of 2.37.

The internals were also wobbly, with Indirects taking 60.5%, up from 58.3%, but also far below the recent average of 69.3%. But weakness in foreign demand was offset by a surge in domestic demand, with Directs taking a new record high of 30.7%.

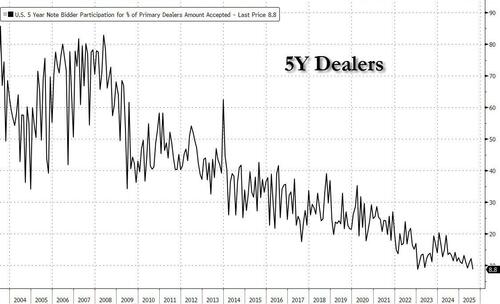

This left just 8.8% for Dealers, tied with the previous record low from Jan 2023.

And overall:

While this was generally a disappointing auction, although with some silver linings below the surface, clearly the market did not care, and 10Y yields slumped to the day’s lows shortly after the auction.

Tyler Durden

Wed, 08/27/2025 – 13:35