WASHINGTON- Airports in the United States represent some of the most valuable public assets in the world, with estimated net values reaching into the billions. Yet unlike in Europe or Asia, nearly all major airports are owned by local governments and tightly regulated by the federal government.

For airlines such as American Airlines (AA), Delta Air Lines (DL), and United Airlines (UA), this means operating from hubs where ownership limits flexibility, and municipal revenues remain locked inside the airport system rather than benefitting the communities that own them.

Photo:- By Sharon Hahn Darlin – https://www.flickr.com/photos/sharonhahndarlin/51224883627/, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=106296952

Photo:- By Sharon Hahn Darlin – https://www.flickr.com/photos/sharonhahndarlin/51224883627/, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=106296952US Airport Privatization

Unlike Canada, where NAV CANADA independently manages air traffic control, or the U.K., where many airports operate under private ownership, the U.S. model remains government-heavy.

The Federal Aviation Administration (FAA) provides both regulation and air traffic control, while the Transportation Security Administration (TSA) regulates and operates passenger screening. This overlap often reduces accountability and limits efficiency.

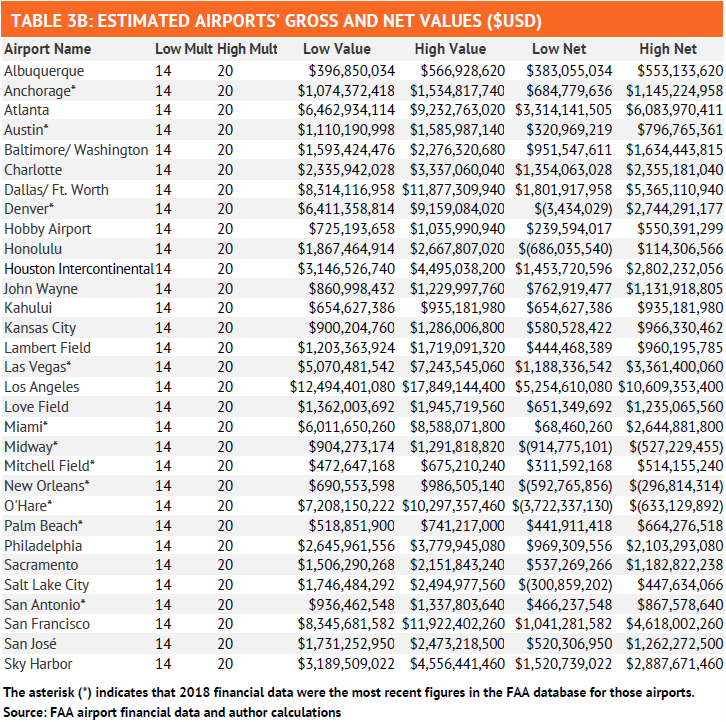

Airports in the U.S. are owned by cities, counties, or local authorities. Their assets are immense: Los Angeles International (LAX) is valued between $12–18 billion, Chicago O’Hare (ORD) between $7–10 billion, Dallas/Fort Worth (DFW) between $8–12 billion, and Phoenix Sky Harbor (PHX) between $3–4.5 billion.

But these funds remain locked within the airport system due to federal grant restrictions that prevent revenues from supporting local budgets, pensions, or debt reduction.

Privatization—through outright sales or long-term leases—could unlock this value, allowing municipalities to capture revenue while enabling airports to operate more efficiently under private management, ViewfromtheWing reported.

Dallas Fort Worth International Airport; Photo- DFW Airport

Dallas Fort Worth International Airport; Photo- DFW AirportGlobal Lessons from Privatization

A National Bureau of Economic Research study examining 2,444 airports across 217 countries (1996–2019) found that privatization alone does not guarantee improved performance. However, outcomes differ sharply depending on ownership type.

- Private equity-backed deals delivered the strongest results:

- Passenger traffic rose by 87% post-privatization, with 21% more passengers per flight.

- More international routes and low-cost carrier options were added.

- Cancellations decreased, and income rose by 108%, driven by retail and fee revenue rather than cost-cutting.

- Gains were largest where airports faced competition and when agreements were structured as long-term leases.

- Non-private equity ownership, often seen in less transparent markets, showed minimal improvements, usually relying on cost reductions rather than growth-driven strategies.

Private equity owners also introduced professional management practices, expanded capacity, and encouraged airline competition. This broke traditional ties between airports and state carriers, improving consumer choice and service quality.

Los Angeles Airport; Photo: Anglas | Goodcon.com

Los Angeles Airport; Photo: Anglas | Goodcon.comBalancing Costs and Benefits

Privatization may raise airport fees, increasing costs for airlines. However, competition and capacity expansion often offset these costs for passengers by lowering fares and expanding service options.

For municipalities, privatization represents a chance to convert underutilized assets into funds for essential services, infrastructure upgrades, or financial stabilization.

With over $130 billion in value tied up across 31 U.S. airports, the potential benefits are significant. The challenge lies in structuring privatization to maximize community and passenger gains without sacrificing accessibility or affordability.

Photo: FAA

Photo: FAABottom Line

Airports are not the only government-owned resources with untapped value. The federal government controls more than 600 million acres of land, accounting for over a quarter of U.S. territory.

Similar debates about privatization and public benefit apply here, underscoring the larger question: should valuable public assets remain locked, or be leveraged to support taxpayers directly?

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News

Top 10 Most Expensive US Airports to Fly From in 2025

The post US Airport Privatization: Unlocking $130 Billion in Hidden Value appeared first on Aviation A2Z.