What’s The Opposite Of „Quiet Day”?

By Michael Every of Rabobank

There haven’t been any ‘quiet days’ in 2025 in global strategy, just a constant flow of conflating developments across geopolitics and geoeconomics. The last 24 hours have been no exception.

Israel struck Hamas leaders in Doha, Qatar, which may — unconfirmed — have killed their negotiating team; or at least the hardline ones who yesterday refused Trump’s ‘final’ deal, 24 hours after he had warned there’d be consequences if it was rejected. This has seen fears of regional contagion, but Qatar –already attacked by Iran earlier in the year– has no real armed forces of its own, just the largest US airbase in the Middle East.

International condemnation has been swift. Even Trump posted in opposition, stating he hadn’t known about the attack until the last moment and had tried to warn Qatar (which should have been able to detect it itself; and Turkish sources are claiming they tipped Doha, and Hamas, off). Trump added it should be used as a platform for peace and that he will be deepening defence relations with Qatar ahead. There are layers of misperceptions, misstatements, and potential missteps in all this, but it suggests further shifts in the region – we shall see if it’s towards peace or more conflict.

Meanwhile, while Europe then slept, Russian (Iranian-designed) drones made a mass attack on Ukraine and also entered Polish airspace, seeing several EU states’ F-35s scrambled and Polish airports close as far as Warsaw. One US Representative posted:

“Russia is attacking NATO ally Poland… This is an act of war, and we are grateful to NATO allies for their swift response to war criminal Putin’s continued unprovoked aggression against free and productive nations. I urge President Trump to respond with mandatory sanctions that will bankrupt the Russian war machine and arm Ukraine with weapons capable of striking Russia. Putin is no longer content just losing in Ukraine while bombing mothers and babies, he is now directly testing our resolve in NATO territory. Putin stated that “Russia knows no borders.” Free and prosperous nations will teach Russia about borders.”

Indeed, while Trump had earlier continued US-India online détente in posting he still expects a trade deal to be agreed, he then told Europe it must put 100% tariffs on China and India to stop Putin, which he would follow. To say that this has major consequences is an understatement: most so if this is done, but also if it isn’t – because that would makes clear the EU (and US) are not prepared to use sufficiently strong economic statecraft, which leaves them with either military statecraft or nothing. Run the fat tail risks on both.

At the same time, Nepal just lost its PM after violent public protests seeing its parliament burned – the tiny state sandwiched between giant India and China is a focus of their (and others) attention.

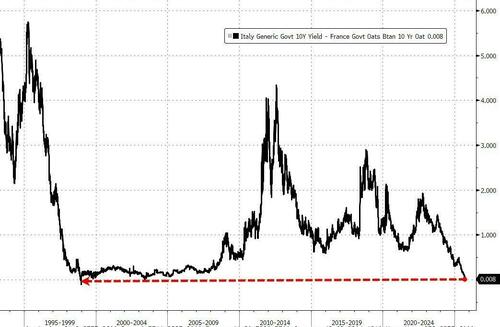

French President Macron appointed 39-year-old Defence Minister Lecornu as his latest prime minister… how long will he last as French borrowing costs now top Italy’s in what Bloomberg calls ‘an historic market shift’? And who is left as the Eurozone ‘core’ now vs the ‘periphery’, and what percentage of Eurozone GDP do they represent? I’m asking for a central bank friend.

Indonesia, also facing large public protests –the finance minister’s house was burned down before they stepped down– has seen its president ask the central bank to directly lower the cost of borrowing for his admin’s key projects, via “burden sharing”. At least it answers the question, “What is GDP for?”

In this geoeconomic maelstrom, China is aiming to shore up ASEAN ties, the SCMP reporting that “Ahead of next week’s 22nd China-ASEAN Expo, commerce ministry official says the trade partners could formally secure closer economic ties this year”. So, larger ASEAN trade deficits with China it will be then; and the US won’t allow any transshipment to send those goods their way. Yet Europe doesn’t have any such barriers in place, and if it raises them, it’s again moving into a US trade bloc, as we had projected.

In purely economic news, as if there can be any such thing nowadays, the FT says Rachel Reeves is to tell ministers to prioritize the fight against UK inflation as Labour MPs are instead “increasingly concerned about the ‘straitjacket’ imposed on economic policy.” Aren’t we already seeing “rate cuts!”?

Similarly, the WSJ reports that ‘Inflation Erased US Income Gains Last Year’ as “High-income households fared better than others, while women lost ground to men.” That doesn’t sound like Main Street is beating Wall Street.

Neither did the -911K downward revision of US payrolls data in the year to March 2025, which presents a very different outlook for the economy than previously seen and, as I noted a few weeks ago, leaves one wondering why we bother to look at those data – besides the monthly casino routine of higher/lower than that is. Bloomberg also says 1/3 of the top jobs at the BLS are currently unfilled, which doesn’t suggest data quality is going to get any better soon – but, hey, a wider, wilder range of outcomes in the monthly casino, right? VP Vance posted: “It’s difficult to overstate how useless BLS data had become. A change was necessary to restore confidence.” But change to what?

Moreover, a US judge ruled allegations of mortgage fraud sent to the DOJ do not apparently constitute necessary “for cause”, or notice, for Trump to have fired her, hence Governor Cook can remain in the job for next week’s FOMC meeting. Again, expect this to be appealed and/or end up at the Supreme Court, where some suspect it will be reversed as part of an extension of executive power over civil servants (the so-called Humphrey’s Executor). In the meantime, is Cook, a dove, going to vote for a rate cut or suddenly become a hawk despite the payrolls revisions? Who knows… but politics and personality politics in central banking? Whocouldanooed?!

Moreover, the US Supreme Court also agreed to hear Trump’s IEEPA tariff appeal in November.

In markets, Anglo American and Teck are to merge, creating a copper mining giant with a market value of more than $53bn, which given how crucial copper is to energy systems, which are crucial to AI, which is crucial to national security and any hopes to get us out of our high debt, high inflation, low productivity slump, obviously won’t be subject to any economic statecraft pressure from either the US or China. Honest. It’s all going to be “because markets.”

Lastly, the SCMP says ‘China offers funding for stablecoin research as global interest grows’ where “The country’s largest state research bureau is offering grants for the study of the digital assets – and how to monitor their movements.” Might that have something to do with the looming introduction of USD stablecoins, and their ability to de facto dollarize other economies?

Like I said, it’s far from quiet. Some messages are being screamed as loudly as they can, even if they are then distorted by their volume.

Tyler Durden

Wed, 09/10/2025 – 12:20