Yields Spike After Trump Hints At Powell Lawsuit, Attention Turns To Coming Hot PCE Print

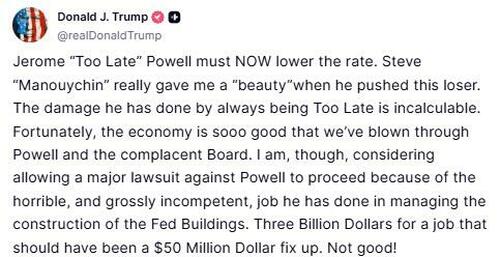

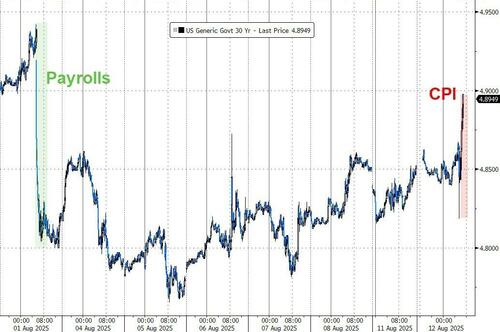

The yield curve is steepening, with 10-year yields spiking from the CPI aftermath (where focus has turned to the red hot Supercore inflation print) and hitting session highs after Trump took to Truth Social to slam Jerome Powell again, just two weeks after the two of them appeared to have patched things up.

Powell upgraded from numbskull

*TRUMP SAYS POWELL IS A 'VERY GOOD MAN’: POOL https://t.co/Q91jQozFS3

— zerohedge (@zerohedge) July 25, 2025

After several days without any direct attack on Powell, Trump resumed the onslaught and said he’s considering allowing a lawsuit against the Fed chair related to the building work at the central bank’s buildings.

As Bloomberg notes, the jump in yields might serve as a reminder of what we have learnt over and over again in Latin America – when the executive tries to press for lower rates, borrowing costs tend to go up rather than down.

Trump aside, the rates market took a relief straight after the US CPI release as tariffs pass-through to goods prices looked light. However, the 32bp m/m core CPI in July was still the hottest since January while the Supercore CPI print was especially jarring.

One problem: supercore surging pic.twitter.com/7xZPblqGiZ

— zerohedge (@zerohedge) August 12, 2025

Also, UBS notes that the July PCE number is likely to be a hot one as medical care services printed 79bp m/m. PCE places 20% weights on medical care while CPI only puts 6% weights. Ultimately, the Fed targets PCE not CPI.

Tyler Durden

Tue, 08/12/2025 – 10:10