Yields Spike After Very Ugly, Tailing 30Y Auction Sparks Steepening Fears

After two decidedly ugly auctions, including a poor 3Y on Tuesday and a very poor 10Y yesterday, moments ago the Treasury concluded the week’s trio of refunding auctions when it sold $25BN in 30Y paper. And this particular auction may have been the worst of the lot.

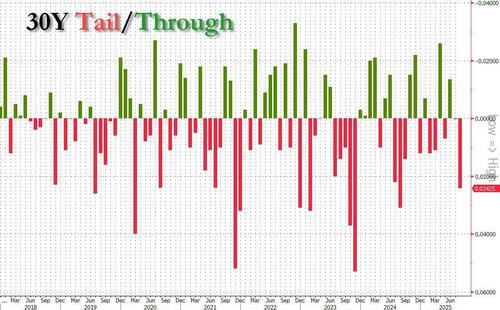

The final refunding auction priced at a high yield of 4.813%, which while lower than July’s 4.889% was not low enough, and with the When Issued at 4.792%, the auction tailed the When Issued by 2.1bps, the biggest tail since last August.

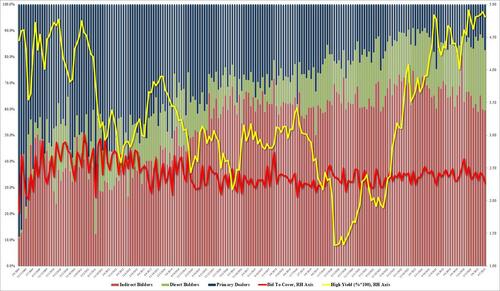

The bid to cover was just as ugly: dropping to 2.266% (from 2.383) it was the lowest since November 2023 (and obviously far below the six auction average).

The internals were not quite so fire, although here too the picture was bad: Indirects dropped again, sliding from 59.8% in July to 59.5%, the lowest since May – which was a major outlier – and the second lowest going back all the way to 2021. And with Directs awarded 23.03%, down modestly from 27.40% last month and below the six-auction average of 24.2%, Dealers were left holding a whopping 17.46%, the highest August 2024 when they were left holding 19.18%.

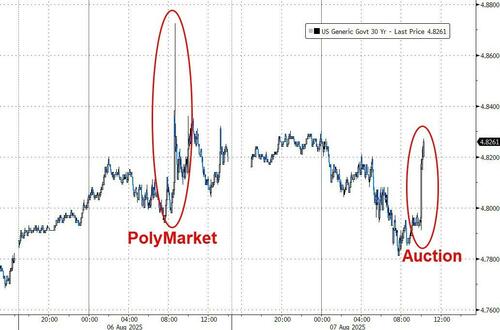

Bottom line: the last coupon auction of the week was also the ugliest, and the bond market saw right through it, sending 10% yields surging to session highs, just around 4.25%. What is more ominous, is that today’s auction is a harbinger of what will happen when Powell finally does cut, and the market immediately reprices inflation expectations, sending long end yields exploding higher in a steepening move that will make your nose bleed.

Tyler Durden

Thu, 08/07/2025 – 13:33

![Z maczetą na matkę. Agresor z zarzutami [WIDEO]](https://radio.lublin.pl/wp-content/uploads/2025/08/353-273016_g-2025-08-07-210622.jpg)