„Real Distress” Hits Solar Industry As Bankruptcy Tsunami Looms

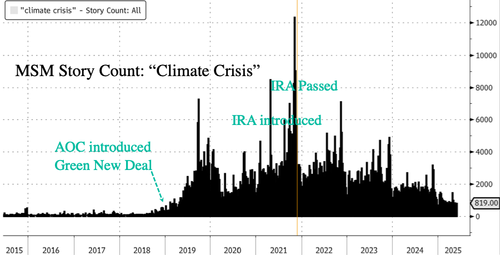

It’s no secret that progressive billionaire elites, their dark money-funded NGOs, far-left lawmakers, and legacy corporate media orchestrated one of the most elaborate propaganda campaigns in recent memory—weaponizing the narrative of an imminent „climate crisis” to ram through green legislation on Capitol Hill. The result? A massive heist on the Treasury, all under the noble guise of saving the planet.

It’s almost as if the „climate crisis” only dominated headlines when Democrats needed political cover to push green legislation through Capitol Hill…

Now, the darker side of the green scam is coming into focus. Reuters reported earlier this week that a draft tax bill released by Senate Finance Committee Chair Mike Crapo (R-Idaho) proposes an accelerated phaseout of clean energy subsidies established under the Biden-Harris regime’s 2022 Inflation Reduction Act. Specifically, the legislation would significantly dial back solar and wind tax credits to 60% of their original value starting in 2026, with complete elimination by 2028. Under current law, these credits are scheduled to begin phasing out in 2032, meaning the proposal would effectively shorten the incentive window.

Crapo stated in a press release that this draft bill „achieves significant savings by slashing Green New Deal spending and targeting waste, fraud and abuse in spending programs while preserving and protecting them for the most vulnerable.”

Slashing clean energy tax credits, essentially the lifeline of the green industry, would unleash a tsunami of bankruptcies across the sector. Think of Solyndra’s high-profile collapse under the Obama administration in 2011—but multiplied many times over.

„It’s not final, but it looks very negative,” said Carter Atlamazoglou, managing director at FTI Consulting, who specializes in renewable energy, referring to the Senate’s latest draft of the tax bill.

Atlamazoglou told the Financial Times, „You’re dealing with a lot of major uncertainty, which makes anyone considering residential solar—from homeowners to financiers—basically wait and see what happens next.”

„Firms are under liquidity pressure and we’re seeing real distress in the industry,” he warned, pointing out that „Things are coming to a head.”

FT cited bankruptcy data showing a sharp uptick in clean energy company failures—starting in 2022 and accelerating significantly by 2024. Many of these firms, heavily reliant on federal tax credits, are now collapsing as subsidies dry up.

Mass liquidations and layoffs are set to plague the industry this year. This trend will be accelerated if those tax credits are eliminated.

„There’s going to be a 50 to 60 per cent downturn in demand. That will wreak havoc on a lot of these solar companies,” warned Ara Agopian, CEO of Solar Insure.

Agopian said, „Many of them will shut their doors as they can’t stay in business without the tax credit.”

Since the release of the Senate draft, solar stocks have crashed: Sunrun is down 36%, SolarEdge is down 30%, Enphase is down 21%, and First Solar is down 19%.

Solyndra’s downfall remains a cautionary tale in the clean energy space…

„We’re looking at a six-month cliff and thousands of businesses having to completely remake their business models in the space of mere months,” CEO Dan Conant of Solar Holler, warned, „It’s just impossible to do.”

Tyler Durden

Mon, 06/23/2025 – 07:45